The Challenge

Among many, here is one example of what keeps us busy:

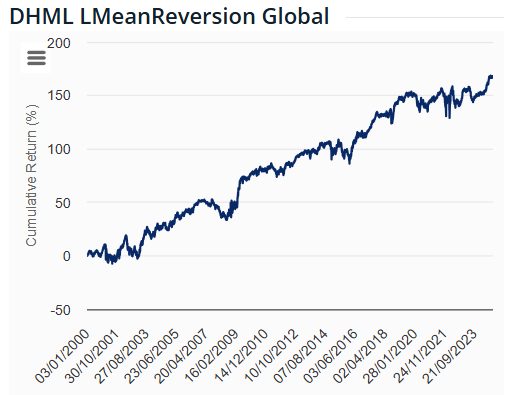

The factor strategy shown in the chart, (number 12 out of a current total of more than 4000) has been running live since late 2014. The 10-year out-of-sample performance is just as good as the in-sample returns from 2000-2014. The theoretical underpinning of long-term mean-reversion is strong as well, as there is little statistical doubt that currencies oscillate in the long run.  But the drawdowns have been brutal. And it took about 5 years for the strategy to clearly break above the most recent 2019 highs.

But the drawdowns have been brutal. And it took about 5 years for the strategy to clearly break above the most recent 2019 highs.

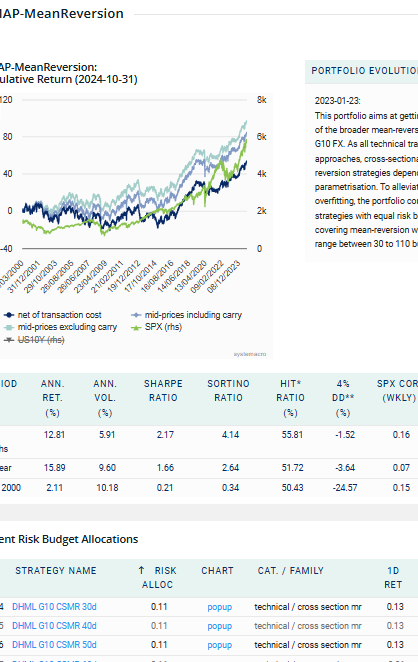

How can an investors harvest this macroeconomic alpha without getting wiped out by these drawdowns and periods of poor performance?

Constructing diversified portfolios of strategies certainly helps, but raises more questions. Equal allocation or not? Dynamic risk budget weights, but how? Which macroeconomic variables can help to produce high-quality performance forecast for mean-variance optimisation? What exactly is the macro regime in which this strategy fails?

Many more questions than answers. And a constant threat of overfitting.

We love the challenge.